For most people around the world, the first association they probably had with a mobile phone was the ubiquitous and reliable Nokia. As one of the initial spear-headers in the mobile phone market, Nokia made mobile phones that were accessible and truly worked: this was in line with their slogan, ‘Connecting People’. Whether it was about making mobile phones more user-friendly and portable or turning mobile phones from business usage to an everyday item that is a social necessity, Nokia certainly lived up to their motto and changed the way people communicate.

The company itself has an interesting history from their origins as a pulp mill, then manufacturing rubber products, and finally entering the telecommunications market. In terms of telecommunications, Nokia is known to be one of the key pioneers of GSM communication due to its 1101 model, the first mass-produced GSM mobile phone. This was one of the decisive steps in making GSM the dominant network standard.

Nokia was also considered to be the pioneer in the mobile phone software domain for integrating a dedicated mobile phone operating system, Symbian OS. At a time when mobile phones were bulky and had small screens, Nokia introduced bigger screens and addictive games (remember the snake game?) to attract and retain the attention of the user. They introduced camera phones, picture messages, and many other different features at a time when mobile phones were merely used for calling and texting.

Nokia enjoyed an unsurpassed growth in its prime days, fueled by constant innovation and customer-focused design. The company was a major contributor to Finland’s GDP and a major shareholder in the mobile phone market. Even today, after it sold its mobile phone business (devices and services unit) to Microsoft, Nokia continues to be focused on innovating in communications and networking technology. Some of these innovations have been in 5G networks, navigation content, and Maps. Nokia is at the forefront of 5G networks with its 5G-ready network demonstration using the 5GTF standard, and its recent deal with NTT Docomo to provide 5G wireless radio base stations in Japan for the next two years.

Outside of telecommunications, Nokia is innovating in digital health following the acquisition of connected health device maker ‘Withings’, digital media focusing on virtual reality (VR) with its 360-degrees VR camera named ‘OZO’, IoT (Internet of Things) Infrastructure.

Nokia’s innovativeness and a world class patent strategy

It’s easy to see that innovation is an important part of Nokia’s strategy and company culture and this is reflected in their patent filings. Their strong portfolio has become even stronger with the acquisition of Alcatel-Lucent, making Nokia’s patent portfolio very broad and attractive for telecommunications, networking, and mobile devices.

Apart from the high-quality portfolio, Nokia clearly has a dedicated strategic approach to exploit it. This strategy has resulted in Nokia being the licensor for almost all major mobile phone manufacturers, including companies that won the market share from Nokia, namely Apple and Samsung. Back in 2006, Japan-based Kyocera Corp entered a licensing deal for Nokia’s patents on CDMA, PHS and PDC standards after a two-year long patent dispute. In June 2011, following a long lawsuit, Apple settled with Nokia and agreed to an estimated one-time payment of $600 million and further royalties to Nokia. The two companies also agreed on cross-licensing patents for some of their patented innovations.

In 2014, Nokia and HTC settled their patent dispute with a patent agreement, where HTC agreed to pay for licensing Nokia’s patents. In 2016, Nokia signed a licensing deal with Samsung which covered a specific set of their patent portfolio. In July 2017, Nokia and Xiaomi, a Chinese manufacturer of smartphones, wearables, and other hardware, announced that they have signed a multi-year patent agreement, including a cross-licensing deal covering each company’s cellular standard essential patents. In September 2017, Nokia received a favorable decision in a patent license arbitration case with LG, and in October 2017, they received another favorable decision from the International Court of Arbitration stating that BlackBerry had failed to make certain payments to Nokia under a patent license contract. In December 2017 Nokia announced that they signed a multi-year patent license agreement with Huawei, one of China’s largest companies and one of the world’s leading smartphone manufacturers.

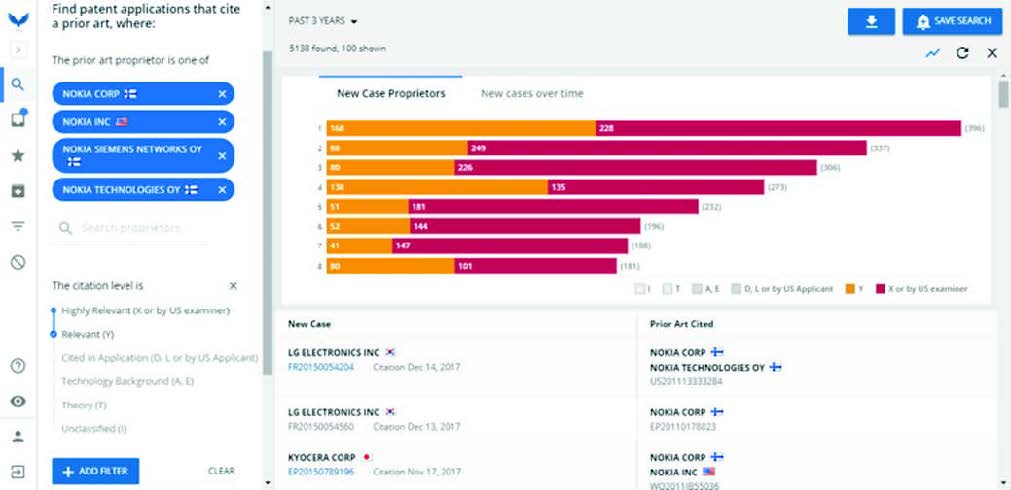

Correlation between licensing and citations In a situation like Nokia’s, where the company has a high-quality patent portfolio and a strong licensing and enforcing strategy, it is interesting to see the correlation between forward citations and licensing deals. If we conduct a search for forward citations of Nokia’s patents in the past 3 years in Citation Eagle, developed and managed by Practice Insight, we can see 5138 cases where Nokia’s prior art has been cited by examiners as ‘Highly relevant’ (X) or ‘Relevant’ (Y). See Figure 1 below.

Huawei leads the ranks with the most recent cases where Nokia’s prior art has been cited by the examiner as ‘X’ (highly relevant). In total, Huawei’s new cases have received 249 ‘X’ and 88 ‘Y’ citations of Nokia’s patents in the past 3 years.

Samsung has the highest total number of ‘X’ and ‘Y’ citations of Nokia’s prior art, 396, of which 228 are ‘X’ and 168 ‘Y’. LG electronics follows with a total of 273 ‘X’ and ‘Y’ citations (135 ‘X’ and 138 ‘Y’ citations) followed by Qualcomm, Ericsson, ZTE, and Intel. A quick filter to only look at BlackBerry as a new case proprietor in Citation Eagle shows that in the past three years BlackBerry’s patent applications received 56 examiner citations marking Nokia’s patents as ‘X’ (highly relevant) and 35 citations marking Nokia’s prior art as ‘Y’ (relevant). With these numbers, BlackBerry certainly seems to have a significant dependence on Nokia patents. A filter with ‘Xiaomi’ shows 37 ‘X’ and 15 ‘Y’ citations and a filter with ‘Apple’ shows 40 ‘X’ and 28 ‘Y’ citations; these can also be considered signs of good prospective licensing leads for Nokia purely from the citation dependence angle.

Although the before mentioned licensing agreements were partly made many years ago, even when looking at the past three years Kyocera and HTC still have ‘X’ and ‘Y’ examiner citations of Nokia’s patents. ‘Kyocera’ results in 47 ‘X’ and 17 ‘Y’ citations, whereas a filter with ‘HTC’ shows 7 ‘X’ and 9 ‘Y’ citations. Possible new leads for Nokia – latest citations It is worthwhile exploring some of the latest citations of Nokia’s prior art (by filtering for ‘Past Year’ only in Citation Eagle). This shows some possible licensing leads in the new areas that Nokia is tapping into digital health, digital media, and other technology areas.

Digital media

In the digital media area, Nokia’s OZO VR camera ‘Oculus Rift’, now a division of Facebook, is a well-known name in the virtual reality (VR) headset technology area. Oculus VR’s patent application received a ‘Y’ citation of a Nokia patent in September 2017. It will be interesting to see if there is a dependence here and a possibility for some collaboration and agreements.

Sling Media is a US-based technology company that develops Smart TV and place-shifting solutions for multiple-system operators, set-top box manufacturers, and consumers. In February last year, two patent applications from Sling Media received ‘X’ citations of Nokia’s patents. Again, this could be considered as a lead to discuss collaboration or licensing opportunities. Immersion Corp is a US-based developer and licensor of touch feedback (haptic) technology. In April and July last year, two patent applications from Immersion Corp received ‘X’ citations of Nokia’s patents. Although slightly narrow in terms of technology, this is also an arena for fully immersive digital media experiences and Nokia could try to explore synergies with its VR division. Synergies can also be discovered in the case of Vuzix Corp, a US-based smart glasses and Augmented Reality (AR) technology manufacturer, whose two patent applications received ‘X’ and ‘Y’ citations of Nokia’s patents in April and February last year, respectively.

Digital health

Covidien, now Medtronic Minimally Invasive Therapies, is a global healthcare solutions company that develops surgical and diagnostic devices, among other technologies in the med-tech space. Two of Covidien’s patent applications have received one ‘X’ and one ‘Y’ citation of Nokia’s patents in March and September 2017 respectively.

Other technology areas

Apart from digital health and digital media, one example of the other area where Nokia could find leads is within the wireless charging area. In February and April last year, Energous, a company focusing on wireless charging technologies for wearables, received ‘X’ and ‘Y’ citations of Nokia’s patents for its two patent applications.

Also, Bragi GmbH, a wireless ‘smart’ earphone manufacturer, whose patent application received an ‘X’ citation of a Nokia’s prior art in March last year. It will be interesting to see how much technological dependence this citation might mean and if Nokia sees a licensing opportunity here.

All the above examples show how a high-quality patent portfolio coupled with regular citation analysis can result in actionable leads for either cross-collaboration or, in some cases, an aggressive licensing strategy.

To see how you can boost your patent portfolio, visit Citation Eagle for a free 14 day trial.