IP ProPatent Article

Autonomous vehicles are not a futuristic concept anymore – they are here, and their readiness to be accessible to the public is increasing with each passing day. Along with the technology’s application in many areas, the most exciting and perhaps the most visible to the public is the application of autonomous vehicles in taxi and ride-sharing services.

Autonomous vehicles are not a futuristic concept anymore – they are here, and their readiness to be accessible to the public is increasing with each passing day. Along with the technology’s application in many areas, the most exciting and perhaps the most visible to the public is the application of autonomous vehicles in taxi and ride-sharing services.

Already in the first half of 2018, Waymo received a green light to offer a fully autonomous taxi service in Arizona. Soon the general public will be able to get a first-hand experience of what it is like to ride in an autonomous vehicle. This will also be a completely new test for Waymo in terms of the market and consumer acceptance of the autonomous vehicles.

Waymo certainly won’t be the only company to offer autonomous rides to the public:

- Singapore based NuTonomy received approval to begin testing its driverless taxis and also have the funding from Grab and Ford to assist their development.

- Uber have been testing their self-driving cars for the last few years.

- Lyft have announced their intentions to introduce autonomous ride services in partnership with Magna, an automotive component provider.

- Two Chinese companies founded by former Baidu executives, ai and JingChi, have announced that they are road testing their autonomous vehicles.

- The Chinese taxi service giant DiDi Chuxing have commenced testing autonomous vehicles in Shanghai.

- Navya, a French autonomous taxi company announced their Autonom taxi, which is said to be production ready, along with an autonomous shuttle offering more seats compared to the traditional 6-seater taxi.

These new initiatives are not just happening with emerging companies, the ‘traditional’ major automotive companies are also joining in on the action. Nissan have announced a testing phase for their Easy Ride robotic taxi service that they have developed in partnership with DeNa in Japan. General Motors are aiming for 2019 as the year in which they will start offering their autonomous Chevy Bolt models as a ride-sharing service. Bosch and Daimler, as a part of their autonomous car development partnership will be testing robotic taxis on public roads in the coming months. Voyage, a new autonomous taxi startup are backed by Jaguar Land Rover’s venture capital arm InMotion Ventures with $3 million investment.

The technology brings with itself the promise of it being low cost in the long term, as the expenditure of driver’s wages will be taken out of the equation. This also raises the questions of large-scale unemployment of skilled drivers, when the technology starts to infiltrate the ride-sharing market. The economics of the situation (cheaper rides) would lure all taxi services to have autonomous cars, resulting in the possibility that the entire ride-sharing market may become driverless in a short span of time.

It’s not just autonomous road vehicles that are emerging on the market. There are several companies working on flying autonomous taxis. This technology is already quite mature and the only thing remaining is regulatory approvals based on testing data. Companies working heavily in this area include:

- Volocopter Taxi have designed a vertical taking-off and landing helicopter taxi that can take passengers between fixed points.

- Uber have recently revealed their ‘Skyport’ proposals for their ‘UberAir’ program. It will have have pilots in its first stage but it is then planned to be made autonomous going further.

- Ehang, a Chinese drone manufacturer have already tested their passenger-carrying quadrocopter Ehang 184, receiving good feedback from the tech community.

Likewise with the on-road autonomous industry, traditional transport corporations have started their foray into this area. Airbus tested their ‘Vahana’, an electric vertical take-off and landing aircraft. They have also developed an E-Fan X prototype in partnership with Rolls Royce and Siemens. Boeing is also backing the development of a small electric jet by Zunum Aero. Although this may very well be outside of the definition of taxi services, it can be used as chartered private transport for consumers.

Flying taxis may bring with them the promise of a faster commute and lower road congestion, but it also brings the problems of public acceptance, noise levels, wind force, etc. However the cost efficiencies of the technology will be probably the main determining factor in bringing the technology to the consumers.

These new disruptions in the traditional transport sector are resulting in great opportunities for law firms and service providers to expand the client base with work with new players. At the same time, the rapid technology changes will result in the established transport manufacturers to work more to stay relevant and retain their market share, meaning more work for law firms and service providers.

While the established players from the automotive and aerospace area have already a large number of patent filings and usually work with multiple law firms, most of the non-traditional new players have very few patent filings and have usually only worked with one or two law firms. For example:

- NuTonomy work with Fish & Richardson US for their PCT filings

- Zunum Aero, the Boeing backed electric jet manufacturer work with Cooley LLP, DC

- Lyft work with one law firm for their representation in the US, EP, CN and CA.

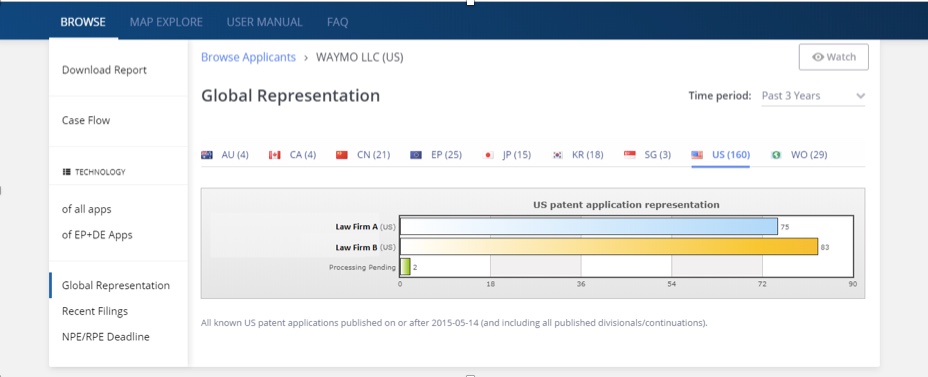

In Filing Analytics, we can see at a glance that Waymo’s filings show that they are represented only by two law firms in the US. For other jurisdictions, they use one or two law firms at the maximum

ii – US Representation for Waymo LLC. Source: Filing Analytics

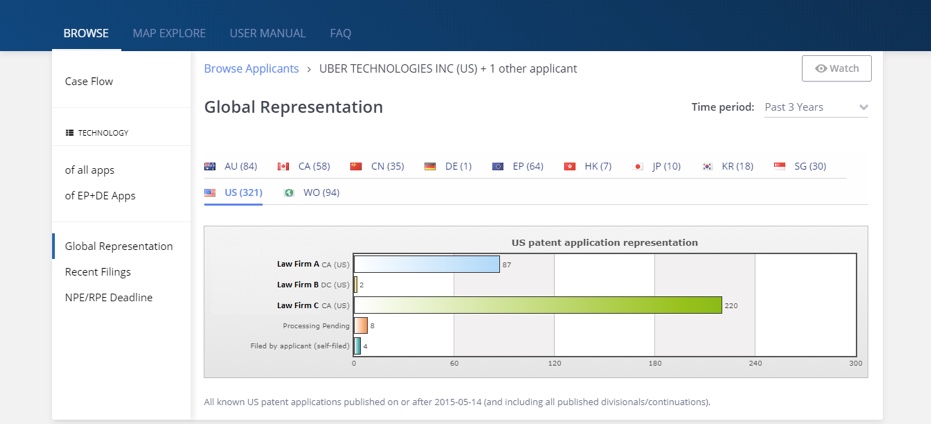

If we take a look at Uber, we can see that although they are now a multinational giant, they still retain a start-up approach to using only a select few law firms.

iii – US Representation for Uber Technologies. Source: Filing Analytics

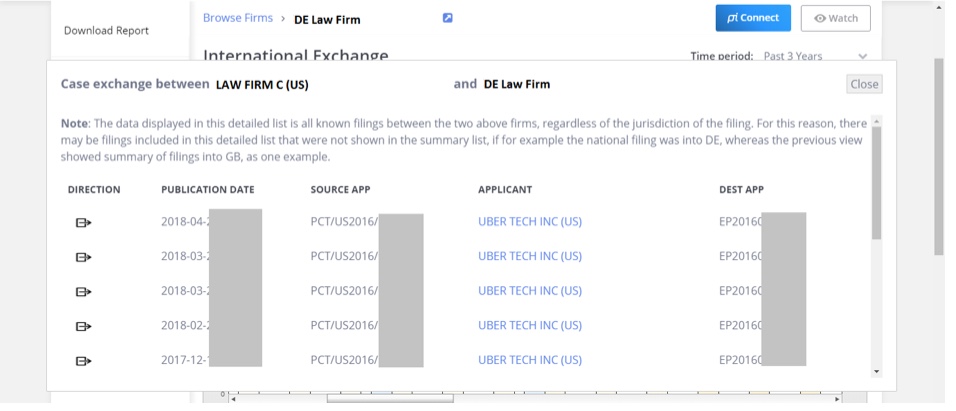

For EP, Uber is represented by a DE law firm, an IE law firm, and 3 law firms from GB. Delving deeper into the reciprocity between the law firm representing them for DE and the law firm representing them in the US, we can see that the filings shared between them have been just for Uber in the last 2 years, and overall, they have collaborated for two filings for another company before.

Also, interestingly, the US law firm shares a lot of cases with other law firms in DE for other clients, but it has an exchange with this law firm for Uber filings. This suggests that the DE law firm has a client-preferred status rather than a partner-preferred status in this relationship.

iv – Case Exchange between DE Law Firm & Law Firm C for Uber Technologies. Source: Filing Analytics

It is quite possible that these start-ups will increase their patent filings and then widen their representation options in the future. It’s also possible that if the start-up doesn’t already have a law firm representation in your jurisdiction, then perhaps you can grab the opportunity to be their representing law firm.

The growth and pace of innovation in this field and the opportunities to work with many start-ups certainly makes it a clear case on why law firms should not overlook the ever-increasing business development opportunities in autonomous transport.

To find out who is working with whom, or which emerging players may need your law firm services, visit http://filinganalytics.io

All this information is publicly available under register sources for different jurisdictions. These actual snippets have been identified using Filing Analytics which collects these information points from diverse sources and makes the data available and easily searchable while providing further analytics on the data.